The World Obesity Federation predicts that over 1 billion people will be affected by obesity and nearly 2.7 billion adults will be overweight by 2025. The surging prevalence of obesity is creating extensive awareness among the masses regarding health and fitness. Additionally, private and public organizations are organizing numerous seminars and programs to raise public awareness about health and fitness. Moreover, medical device manufacturing companies are also offering dietician- and nutritionist-backed tips, suggestions, and advice to encourage the usage of wearable medical devices.

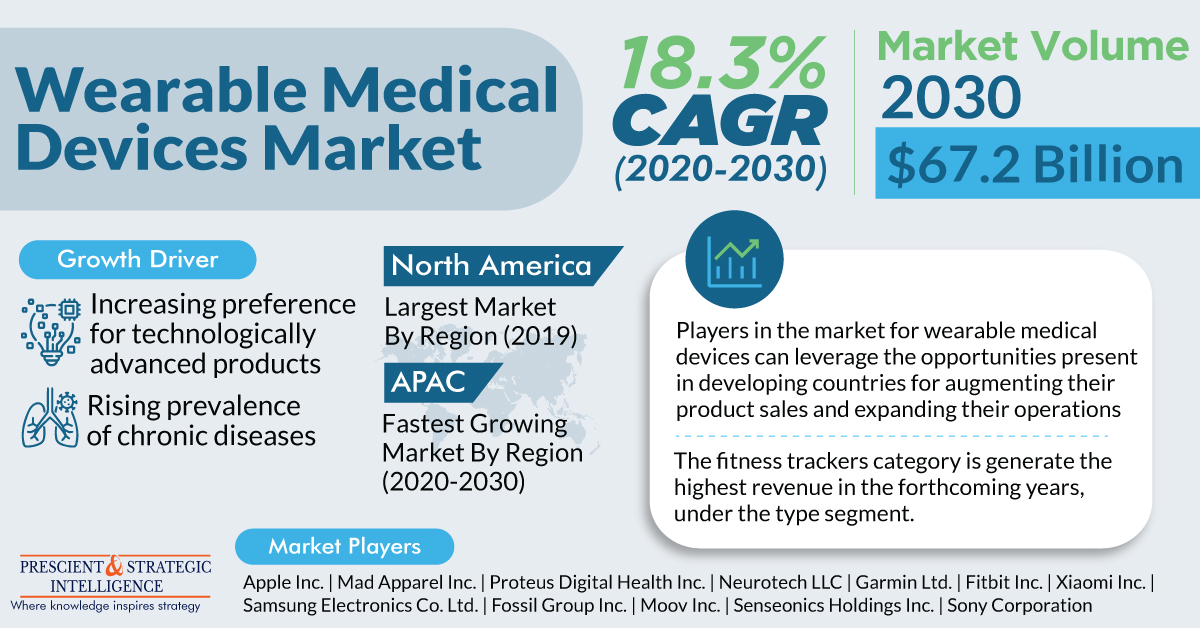

Thus, the rising fitness consciousness will help the wearable medical devices market advance at an exceptional CAGR of 18.3% during 2020–2030. The market was valued at $10.6 billion in 2019 and it is projected to generate $67.2 billion revenue by 2030. Moreover, the rising cases of chronic diseases, such as diabetes and cardiovascular diseases (CVDs), will also propel the adoption of wearable medical devices in the upcoming years. The International Diabetes Federation (IDF) forecasts that approximately 700 million people in the 20–79 age group will be living with diabetes by 2045.

In the forthcoming years, fitness trackers will be preferred over smartwatches, smart cloths, breath analyzers, hearing aids, and patches, owing to the rising public consciousness regarding the number of steps being taken, calories being burned, and their overall health condition. All the aforementioned wearable medical devices are available at pharmacies, online platforms, and hypermarkets. In recent years, online distribution channels recorded the highest sales of these products, due to the availability of a wide range of medical devices on e-commerce platforms at cost-effective rates and the provision of home delivery services and online payment options by these portals.

These distribution channels offer wearable medical devices manufactured by Mad Apparel Inc., Xiaomi Inc., Medtronic plc, Apple Inc., Samsung Electronics Co. Ltd., ZOLL Medical Corporation, Proteus Digital Health Inc., Moov Inc., Fitbit Inc., Neurotech LLC, Senseonics Holdings Inc., Garmin Ltd., and Sony Corporation. Presently, these companies are collaborating to expand their product portfolio. For instance, in November 2019, Garmin International Inc. started collaborating with SCOR Global Life to integrate the Biological Age Model BAM solution of the latter with the wearables data offered by the former.

According to P&S Intelligence, North America led the wearable medical devices market in the preceding years, due to the presence of advanced healthcare infrastructure, high prevalence of chronic diseases, and vast geriatric population in the region. For instance, the Centers for Disease Control and Prevention (CDC) estimates that over 1.6 million people in the U.S. are diagnosed with cancer each year. Additionally, the existence of several leading wearable device manufacturers and frequent product launches are also propelling the sales of these devices in the region.

In the coming years, the Asia-Pacific (APAC) region will adopt a significant number of wearable medical devices, due to the ongoing technological developments in India, China, and Japan, surging healthcare spending, soaring cases of chronic illnesses, booming geriatric population, and mounting investments being made by public and private organizations. For example, the Government of India allocated INR 64,609 crore and INR 67,112 crore to the Ministry of Health and Family Welfare in 2019–2020 and 2020–2021, respectively.

Thus, the surging consciousness among people regarding health and fitness and increasing incidence of chronic diseases will encourage the adoption of wearable medical devices worldwide.