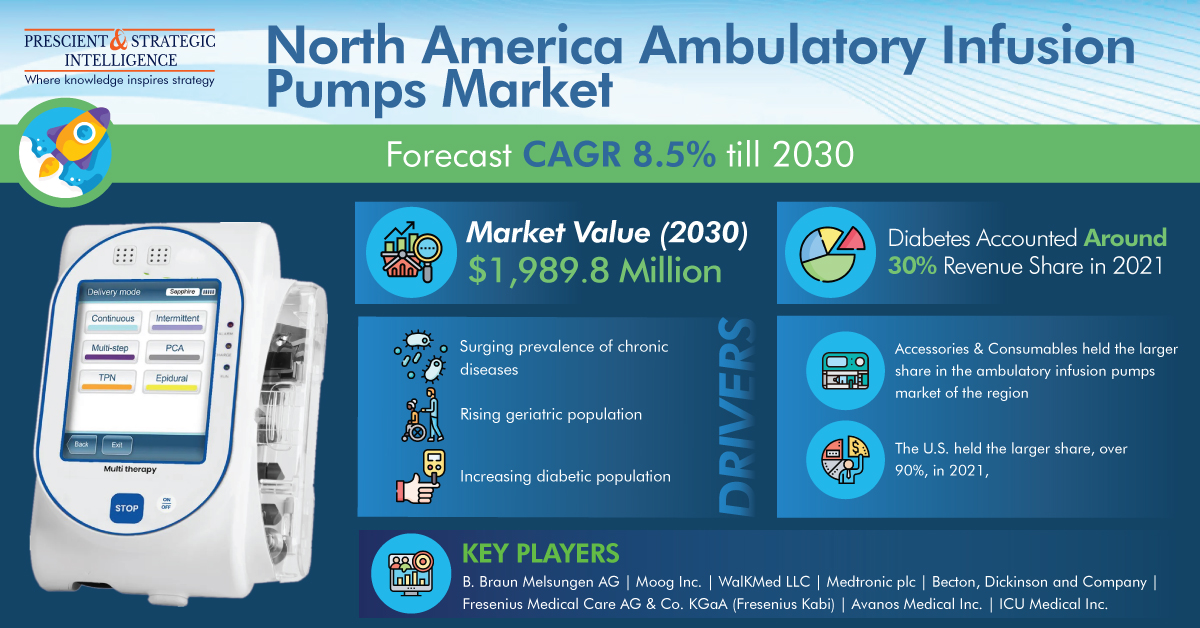

In 2021, the North American ambulatory infusion pumps market was worth around $953.1 million, and it is expected to reach $1,989.8 million by 2030, advancing at an 8.5% CAGR from 2021 to 2030.

The major factors behind the industry growth are the rising geriatric population, snowballing diabetes incidence, surging demand for ambulatory services, and growing prevalence of many other chronic diseases.

The industry growth is also ascribed to the rising awareness about diabetes management and increasing healthcare expenditure. Insulin and obesity resistance have been taken as separate risk factors for diabetes; therefore, the growing obese populace results in a massive demand for insulin delivery devices, which, in turn, boosts the ambulatory infusion pump sales in North America.

Accessories & Consumables Hold Larger Share in Market

Accessories & consumables capture the larger share of the industry, based on product type. It is ascribed to their repetitive buying and presence of a wide range of accessories & consumables across North America.

In 2021, devices too had a significant market share. This can be credited to the surging demand for such pumps for convenience when taking drugs for a wide range of conditions.

Largest Share Is Captured by Diabetes Application

Diabetes holds the largest revenue share of the North American ambulatory infusion pumps market, around 30%, based on application. This can be credited to the rising incidence of diabetes and its complications in the region.

Around 96 million people in the age group of 18 and above suffer from prediabetes, which amounts to 38.0% of the adult U.S. population. As insulin needs to be injected at specific times, an infusion pump replaces the need for numerous regular injections with a single constant infusion.

Ambulatory Service Demand Rising Rapidly

The rising geriatric population and increasing stress on healthcare organizations because of the burgeoning number of patients afflicted with all kinds of diseases are significantly driving the popularity of ambulatory services in the region. This is also ascribed to the low cost of these services and their higher suitability compared to conventional hospital services.

Thus, the count of ambulatory surgical centers in the U.S. has significantly increased in the last few years. The acceptance of ASCs can also be credited to the faster recovery, lower infection risk, shorter stays, and innovative technologies they offer.

The U.S. holds a gigantic share, of over 90%, due to the availability of key players, surging prevalence of chronic diseases, developed healthcare infrastructure, and favorable reimbursement policies. Additionally, the expansion in the count of healthcare settings and the availability of home infusion services propel the industry’s growth.

As per the American Hospital Association, 6,093 hospitals were active in the U.S. in 2021, including 2,960 non-government hospitals and 1,228 investor-owned healthcare facilities.