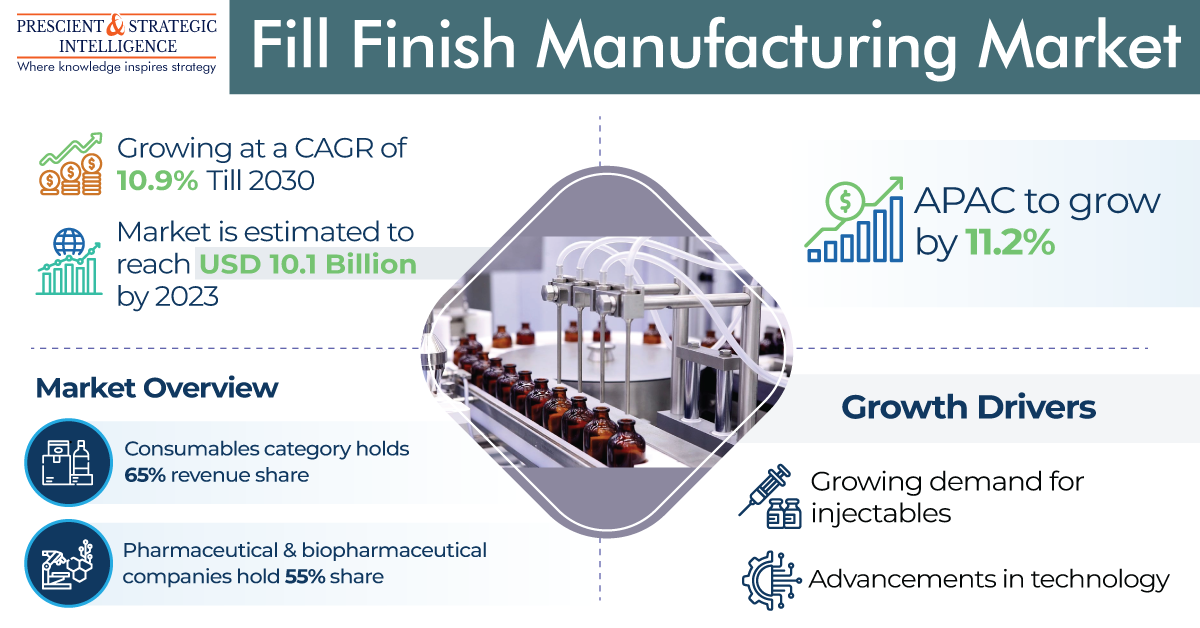

The fill-finish manufacturing market made a revenue of USD 10.1 billion in 2023, and it will touch a value of USD 20.7 billion by 2030, powering at a rate of 10.9% by the end of this decade, powered by the increasing requirement for injectables, as well as biologics and modified medicines.

This procedure plays a significant role in the pharma and biotech sectors by being the last stage in the production process, wherein biologic and synthetic drugs are dispensed into their containers and packed for distribution.

On the basis of the product, consumables led the industry with a share of 65%, in 2023, and it will be like this in the future as well. Consumables put to use in in the fill−finish procedure comprise vials, cartridges, syringes, caps, seals, stoppers, and filters.

Make inquiry before purchase of this report: https://www.psmarketresearch.com/send-enquiry?enquiry-url=fill-finish-manufacturing-market-report

They are often single-use things, meaning they can be used once and then discarded. This trend of single-use consumables has become popular as a result of the growing requirement to decrease the risk of cross infection, attain faster changeovers amid diverse drug products, and minimalize capital investments and cost of maintenance.

Consequently, the requirement for consumables has augmented considerably, therefore powering the industry.

The fill-finish manufacturing market is powered by the growing requirement for injectable drugs. These drugs can be managed at once into the bloodstream or tissue with the help of injections. They are employed for the prevention, treatment, and management of numerous diseases, such as cancers, diabetes, autoimmune issues, and infections.

Such ailments need lasting treatment, often connecting the regular administration of injectable medications. As the existence of these diseases continues to increase, the requirement for parental drugs will also rise, thus contributing to the rise in the requirement for fill-finish services.

APAC was the leader of the pack, with a share of about 45%, in 2023, and this trend will continue in the years to come as well. The main region for this is that the region has a strong presence of pharma and biotech companies.

China, Japan, India, and South Korea are the hubs for pharma production and R&D activities. These have well-established pharma infra, a large and skilled workforce, and advantageous guidelines of the government supporting the development of related businesses.

Furthermore, more than a few biotech and pharma companies from Europe and North-America outsource their final-stage production process to firms based in the region on contract.

It is because of the growing demand for injectables and continuous advancements in technology all over the world, the demand for fill-finish manufacturing is on the rise, This trend will continue in the years to come as well.