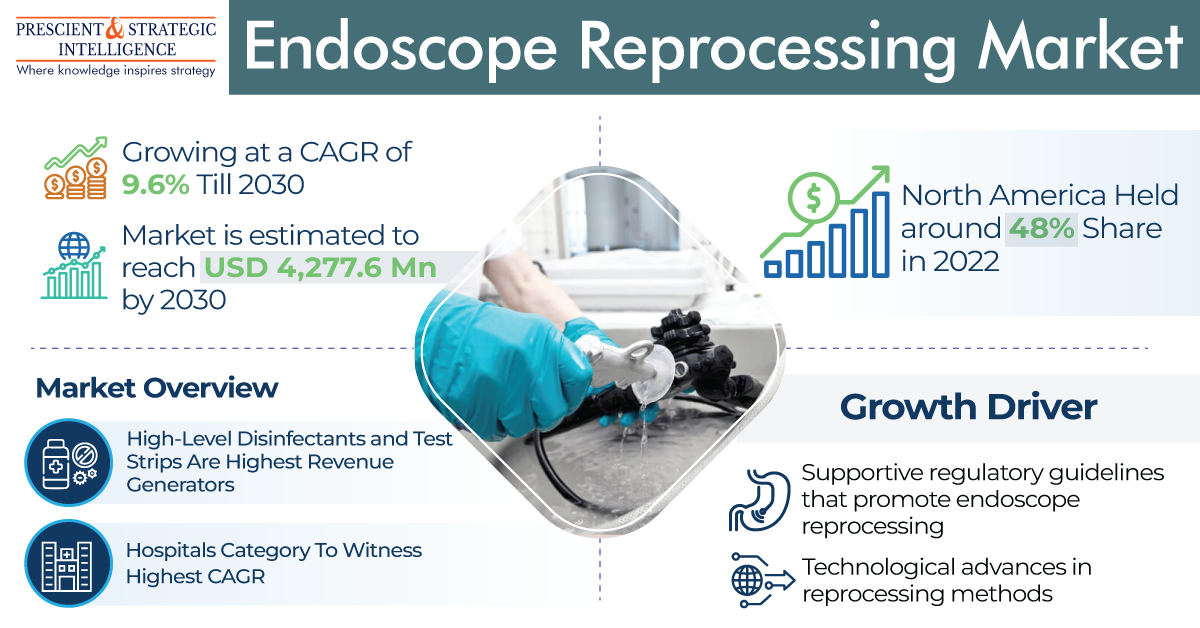

The endoscope reprocessing market size will touch USD 4,277.6 million by 2030, proceeding at a rate of 9.6% by the end of this decade. This is mostly due to the supportive controlling guidelines promoting endoscope reprocessing, growing disease cases requiring endoscopy procedures, and tech progression in reprocessing approaches.

High-level disinfectants and test strips category had about 34% share in 2022, because of the increasing prevalence of numerous endogenous contaminations, for example bacteremia and pneumonia, after endoscopy procedures. Likewise, the acceptance of test strips is growing for the effective measurement of the MEC needed for high-level disinfection, thus delivering faster disinfection reactions.

Furthermore, they support in the discovery of carbohydrates, residual proteins, and hemoglobin on both flexible and rigid endoscopes, via the chart of color comparison.

Reprocessing is mainly done for flexible endoscopes, therefore bringing about their larger share of revenue, of over 65%, in 2022. This is due to the fact that the protuberant players are actively launching AERs that are extremely compatible with flexible endoscopes.

Actually, about 90% of the companies are working on the development of AERs for flexible endoscopes because of their flexibility for controlling and lower weight.

Alterations in the operating environment, for example the increasing stringency of the regulatory necessities associated with reprocessing, are progressing faster than expected. Controlling authorities are taking initiatives for decreasing the chances of HAI’s throughout analysis and treatment.

Hospitals will grow the fastest with around 10% in the years to come in the endoscope reprocessing market. This is because of the increasing count of endoscopy procedures, in addition to the growing count of hospitals at a global level and the declaration of funds and investments delivered by government institutions.

North America led the industry with a share of about 48%, in 2022. This dominance is because of the increasing frequency of tech advancements, increasing elderly populace, snowballing incidence of chronic diseases, particularly gastric ailments; existence of the big names of the industry, improving healthcare services, and snowballing hospital count.

Moreover, the requirement for endoscopies is growing amongst the elderly populace as it is more susceptible to chronic ailments, for example cardiac ailments, blocked arteries, cancer, and GERD. These need GI endoscopies and colonoscopies for their discovery, therefore leading to a surge in the use of endoscopes.

The U.S. is undergoing a demographic shift with the surge in the count of citizens of 65 years or more. According to the U.S. Census Bureau, the age group of people 65 years and older will increase to approximately 24% by 2060.

There is an increase in the number of cases of diseases which require endoscopy procedures, this has a positive impact on the demand for endoscope reprocessing, all over the globe.