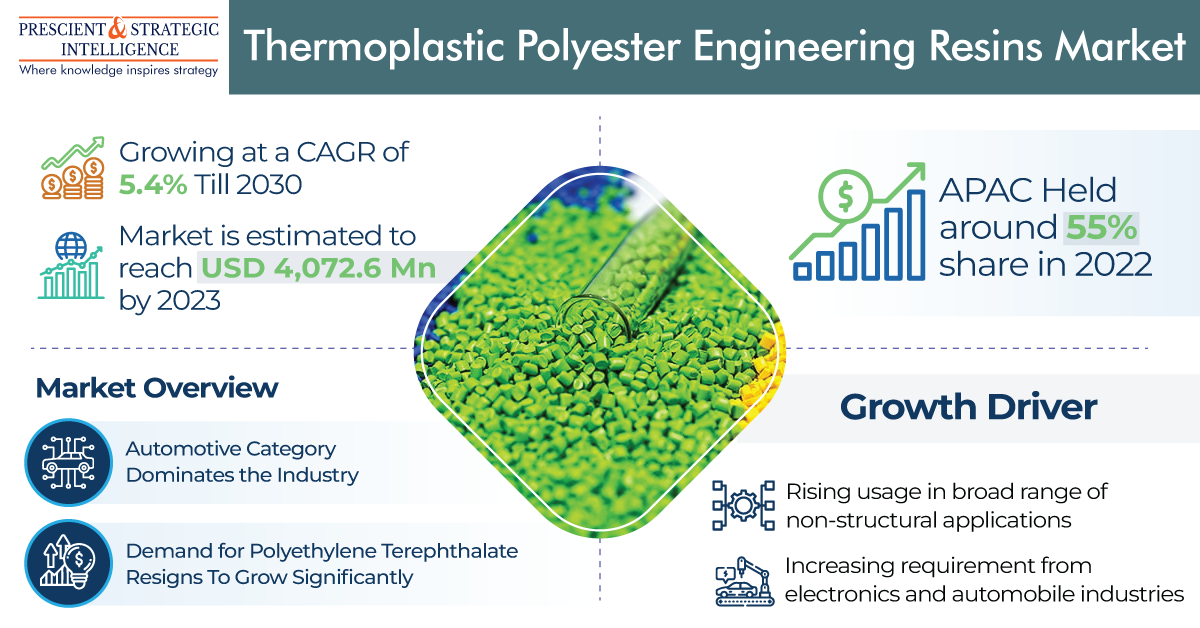

The thermoplastic polyester engineering resins market was USD 3,912.2 million in 2022, and it will touch USD 5,896.6 million, advancing at a 5.4% compound annual growth rate, by 2030.

The growth of the industry is attributed to the increasing utilization of these resins for various nonstructural applications as they can be utilized without filters and are usually tougher and more ductile than thermoset resins. Furthermore, they are extensively accessible to meet domestic requirements and are easy to recycle. The rising need from the automobile and electronic sectors is also propelling the advancement of the industry.

The polybutylene terephthalate category will advance at a steady rate in the years to come. This is because of the growing requirement for PBT in the electrical and automobile sectors. PBT has unique features, including heat resistance, semi-crystalline, and lightweight, because of which conventional materials including bronze, ceramics, and cast iron in the automotive sector are getting replaced.

In 2022, the automotive category, based on application, led the thermoplastic polyester engineering resins market, with 40% share, and it will remain leading in the years to come. The automotive sector has gained momentum, over the past few years, and key manufacturers of automobiles are utilizing thermoplastic polyester to produce parts of vehicles, which benefits them to lessen the overall weight of the automobiles.

In 2022, APAC dominated the thermoplastic polyester engineering resins industry, with 55% share, and it will remain dominant in the years to come. This is primarily because of the increasing requirement for automobiles and electronics in the continent. The requirement for vehicles is speedily rising in regional nations such as China, India, Indonesia, and Australia.

Therefore, the count of commercial, passenger, and local manufacturing facilities of automobiles is quickly increasing in these nations to meet international and domestic needs.

North America is likely to observe significant growth in the years to come. This is primarily because of the mounting need for recycled plastics, the existence of major players, and the growing emphasis on fuel-efficient vehicles, because of which manufacturers are extensively utilizing TPER to make their automobiles lightweight.

With the mounting utilization of such resins for numerous industrial applications, the thermoplastic polyester engineering resins industry will continue to advance in the years to come.