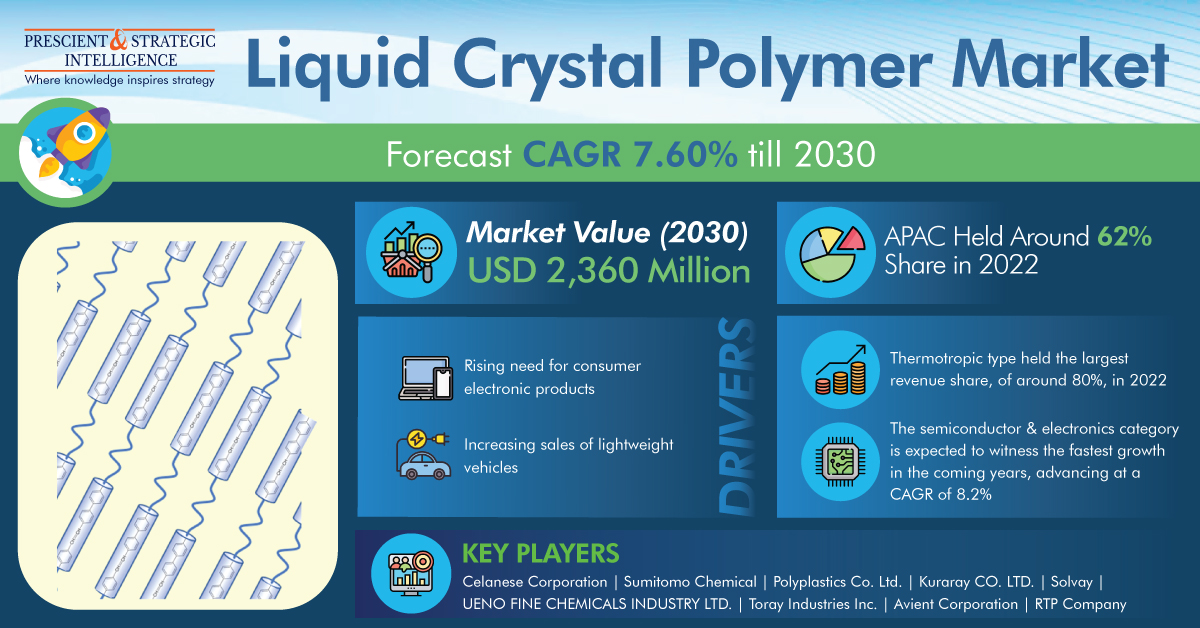

In 2022, the global liquid crystal polymer market had a total size of USD 1,313 million, and it is projected to hit USD 2,360 million by 2030, advancing at a rate of 7.60%, during the projection period. This development of the industry can be credited to the rising demand for consumer electronic items, like tablets, smartphones, smartwatches, and personal computers, and the growing sales of lightweight vehicles.

In 2022, thermotropic type had the largest market share, of approximately 80%. This is mainly because it has brilliant thermal properties, displays superior elastic behavior, and has a low thickness. It also has working in diverse electronic items like tablets, laptops, and televisions.

During the projection period, the semiconductor & electronics category is projected to experience the fastest development, growing at a CAGR of 8.2%. This can be credited to the reduction of electronic items, and numerous features of LCPs like essential flame retardance, excellent chemical resistance, and robust strength at dangerous temp. such superior quality properties allow the use of LCPs in diverse electronic item components and parts, such as antenna substrates, chip carriers and housings, and flexible printed circuits.

In 2022, the APAC region dominated the industry, with a share of 62%, and the region is projected to lead the industry in the future as well. This growth can be ascribed to the fast growth of the electronics sector, inexpensive manufacturing abilities, a vast populace base, and technical improvements in the region.

This industry is also projected to be propelled by the rising need for semiconductor and electronic components in consumer devices and appliances, like calculators, watches, appliances, flat panel TVs, laptops, personal desktops, and tablets.

The development in the requirement for liquid crystal polymers is propelled by the acceptance of such polymers in the rising automotive sector. There has been incredible development in the making of automobiles and also the sales in industries such as China, Japan, India, and the U.S.

The worldwide trend in the market is to make vehicles to fulfill the progressively strict fuel economy orders. One of the major solutions to this puzzle is to make lightweight cars. For example, typically, a 10% decrease in vehicle weight can summon an 8.0% enhancement in fuel economy.

In the medicinal industry, MRI has been utilized in medicinal analysis and treatment of soft tissue visualization. However, procedures that need catheterization in MRI utilize X-ray to direct the catheter because of metal catheter components, which are unsuited with MRI. Such X-ray procedures expose patients and clinicians to ionizing radiation. To decrease the radiation impact, properties of LCPs such as autoclaving and high tensile forte are effective and will be capable of substituting catheter metal components.