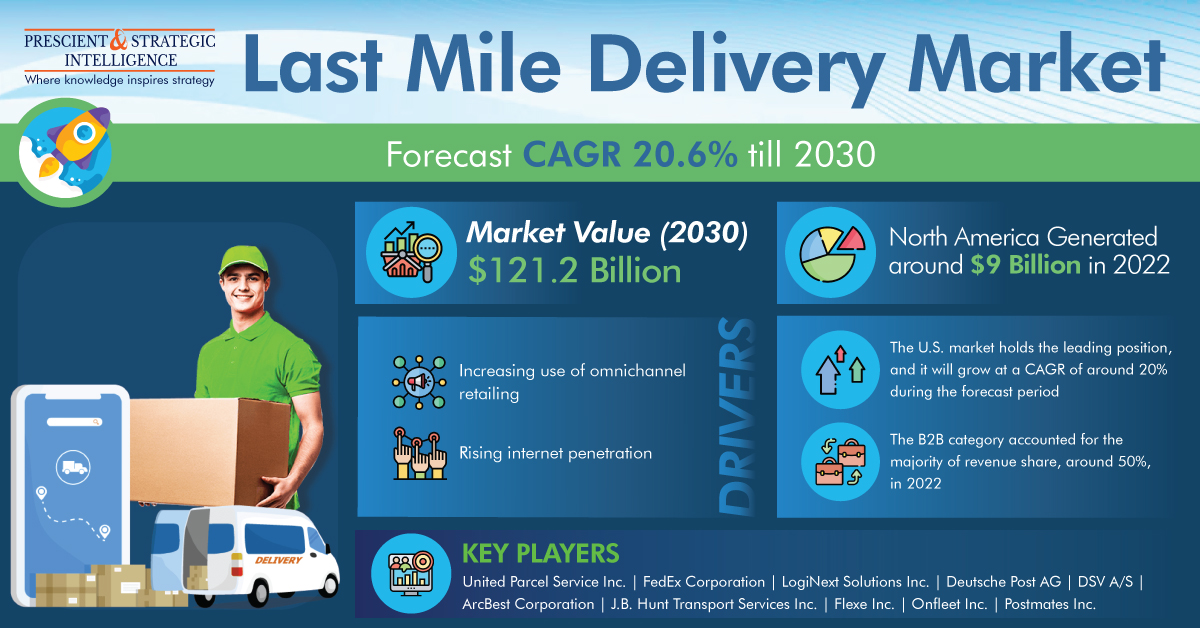

The last mile delivery market was USD 27.1 billion in 2022, and it will reach USD 121.2 billion, propelling at a 20.6% compound annual growth rate, by 2030.

The progression of the industry is mainly attributed to the surging utilization of omnichannel retailing, as well as the significant increase in internet penetration in emerging economies, including Thailand, Indonesia, and India.

In 2022, the B2B category, based on service, dominated the industry, with approximately 50% share. This can be attributed to the fact that it provides numerous advantages to online retailers to attract B2B consumers, for instance, decreased delivery time, easy options of payment, doorstep delivery of heavy parts, heavy discounts on bulk buying, and decreased management expenses.

The B2C category will observe faster growth in the years to come. This is because of the shifting customer purchasing behavior, growing technical knowledge about the utilization of online platforms and smartphone apps, and, development in organized and omnichannel retailing.

Based on application, the e-commerce category will observe the fastest last mile delivery market growth, propelling at approximately 20% CAGR, in the years to come. This is because of the growing customer base, customers’ expectations for fast and free shipping, demographic shift, and competitive pricing. Therefore, businesses are now focusing on overcoming the challenging delivery schedule of conventional logistics.

A major trend being observed in the industry is the implementation of autonomous vehicles for delivery. AI is a major technology for autonomous driving systems, as it is the only tech that allows real-time and reliable object recognition around automobiles. The implementation of autonomous vehicles will significantly decrease delivery expenses, therefore driving the e-commerce sector growth.

In 2022, the North American industry accounted for a significant share, generating USD 9 billion. This is because of the high rate of adoption of advanced technologies in the continent, as well as the rising rate of efficiency expected by last-mile delivery.