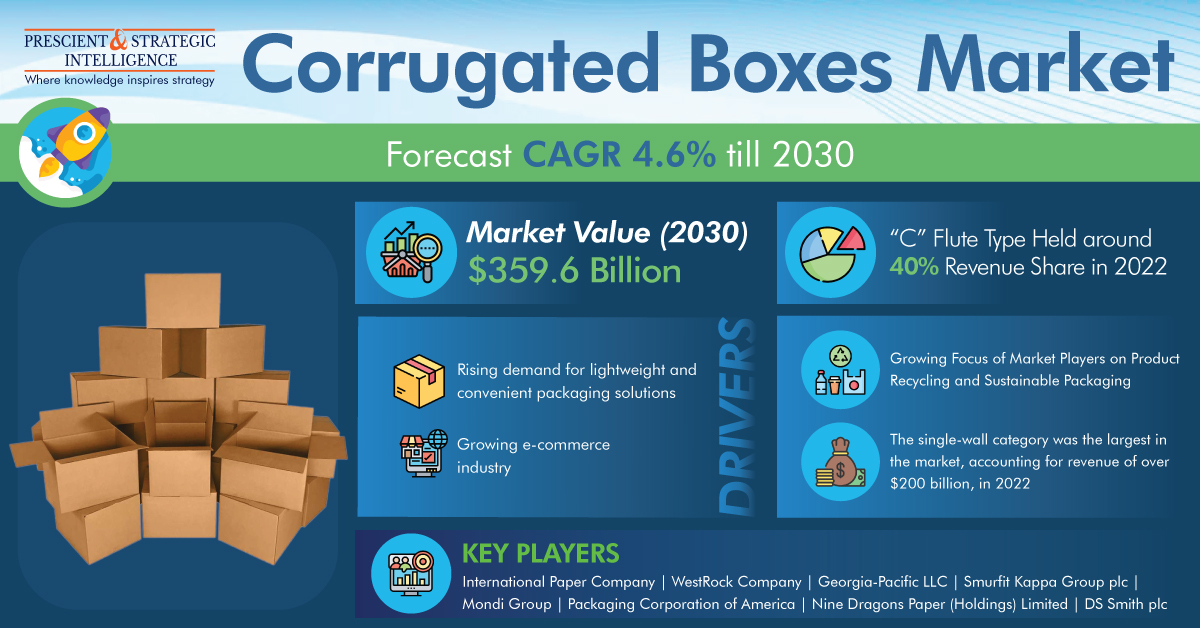

The global corrugated boxes market is projected to be worth USD 359.6 billion by 2030, growing at a CAGR of 4.6%. This development can be credited to the increasing requirement for light in weight and easy packing solutions across diverse sectors.

The surge in the acceptance of corrugated boxes in comparison to other padding solutions, like self-retention packaging, sealing boxes, and plastic boxes, is primarily because of the rising concerns over their sustainability in the value chain.

As corrugated material used is simple to recycle, it is experiencing a high requirement for wrapping applications. Furthermore, retail-ready packaging saves time and labor expenses. Other benefits comprise its ecological nature and lesser price compared to other items, which continue to propel the industry worldwide.

Usually, packing is likely after use, which has directed to a huge surge in the quantity of waste in landfills, therefore resulting in damaging ecological effects. However, builders have now initiated using cutting-edge technologies for slicing and compaction, which aid in the reprocessing of such boxes.

In 2022, the C category held the largest Corrugated Boxes Market share, at approximately 40%. This flute kind discovers high utilization in corrugated boxes for shipping aims, mainly for the padding of glass items, dairy items, furniture, and motorized components.

For example, industry companies offer these boxes for the wrapping of engines, windshields, metallic body pieces, car headliners, and airbags. Such boxes can be loaded and have a better compression forte as they feature a corrugated medium that is rather thick.

One of the major reasons propelling the industry is the development of the wrapping sector worldwide. The surge in the requirement for manufactured goods, ranging from television sets and smartphones to consumable items, like candies, has boosted the requirement for corrugated material, particularly corrugated boxes, for storing and transport drives, credited to their high physical strength and crush resistance.

Furthermore, with the surge in the standard of living, particularly in Brazil, China, and India, there has been a surge in the requirement for items like electronics, cosmetics, and food and beverages. Corrugated boxes are typically suggested for shipping such items, as they are pressure-resilient and more solid than regular cardboard wrapping.