Rising significantly from 2017, the share of the e-commerce sector in the total global retail sales reached 14% in 2018. Further, by 2021, almost 17% of the total retail sales across the world are expected to be made through online shopping channels. This is because such platforms offer customers the price flexibility and fast delivery service they are looking for.

Like companies across various other sectors, forklift manufacturers are also subject to the ill-effects of the COVID-19 situation. Due to the ceasing of manufacturing activities, companies offering forklifts as well as their components would need to alter their strategies and come up with a more-efficient supply chain model. The ripple effects of the current shutdown in several countries are expected to be witnessed till at least the entire 2021.

Forklift Market Segmentation Analysis

During 2014–2019, class 5 forklift trucks generated the highest revenue in the industry, owing to their high popularity in emerging economies, such as China and India. They are preferred for heavy-lift applications, especially in places where the risk of tire punctures is high, as such vehicles have pneumatic tires. Their payload capacity is between 3,000 and 55,000 pounds (1,360 and 25,000 kg), which makes them suitable for heavy lifting.

The counterbalance bifurcation, under segmentation by product, dominated the industry in the past. These trucks have two forks at the front, and they are able to get quite close to the load to be picked and moved. They are designed for varying loads and conditions, which makes them popular for logistical operations.

During the forecast period, the higher value CAGR, of 3.4%, is projected to be witnessed by the electric bifurcation, on the basis of engine type. This is attributed to the rising concerns regarding the emission of greenhouse gases (GHG) from fossil-fuel vehicles. In addition, class 1, 2, and 3 trucks are pressed in lightweight lifting, for which electricity can easily provide the required power. Another reason for the increasing sale of electric forklifts would be the gradual decline in the cost of lithium-ion (Li-ion) batteries.

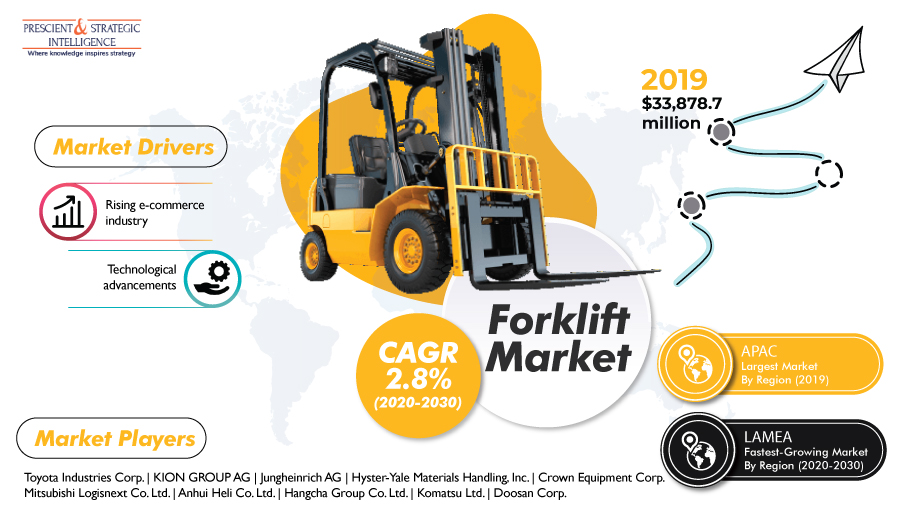

Presently, Asia-Pacific (APAC) is the most lucrative forklift market, due to the rapid growth in the automotive and retail industries in India, South Korea, Japan, and China. In addition, regional governments are implementing strict mandates for security and safety at the workplace, which is leading to the quick deployment of such trucks. In the years to come, the fastest rise in the adoption of forklift vehicles would be seen in the Latina America, Middle East & Africa (LAMEA) region, on account of the swift industrialization and popularity of the warehousing model.