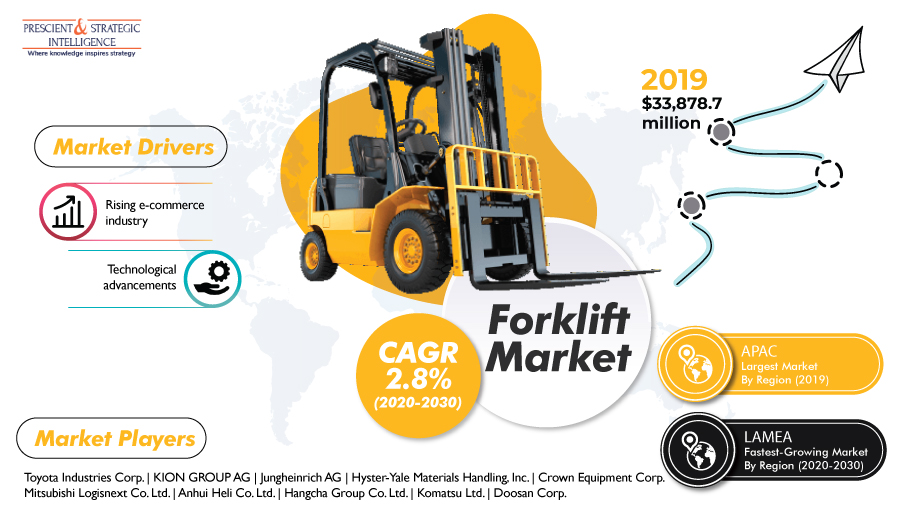

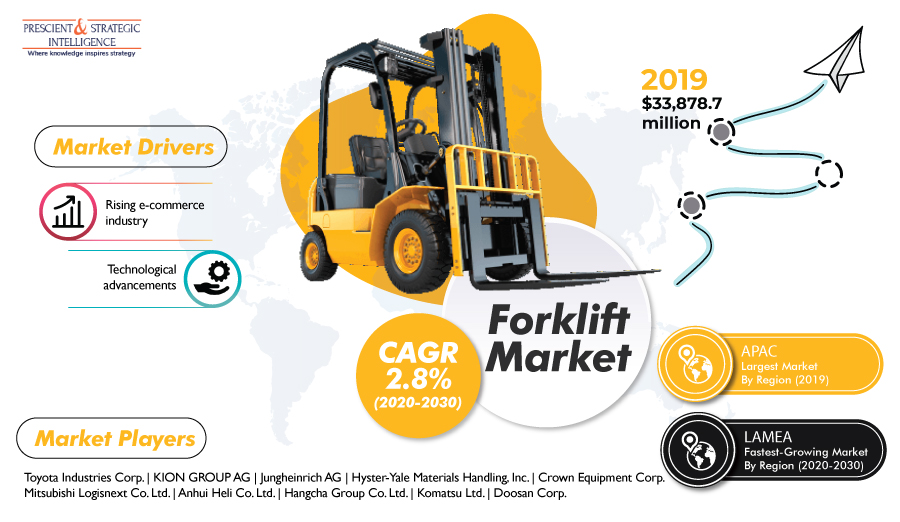

The global forklift market reached a valuation of $33,878.7 million in 2019 and is predicted to generate a revenue of $42,519.4 million by 2030. Furthermore, the market would exhibit a CAGR of 2.8% between 2020 and 2030, as per the estimates of P&S Intelligence, a market research firm based in India. The rapidly growing e-commerce industry and the adoption of advanced autonomous and electric forklift in warehouses and factories are the main factors fueling the growth of the market.

The expanding customer base, changing customer expectations and buying habits, and the increasing popularity of e-commerce are propelling the growth of the forklift market across the globe. The rising popularity of online shopping is pushing up the need for faster deliveries, which is, in turn, challenging the traditional logistics. This is making companies adopt strategies such as making huge investments in autonomous and electric forklifts. This is subsequently fueling the usage of forklifts in warehouses for loading and picking goods.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/forklift-market/report-sample

Additionally, e-commerce organizations are rapidly adopting advanced technologies such as robotics and the industrial internet of things (IIoT) for enhancing their warehouse efficiency. This is causing a sharp surge in the sales of electric forklifts. Moreover, many market players are making huge investments in automation technologies. For example, Hyster-Yale Materials Handling Inc. developed and launched a dual-mode pantograph robotic reach truck in April 2019. The truck is capable of autonomously retrieving and depositing loads from high locations.

Based on class, the forklift market is divided into class 5, class 4, class 3, class 2, and class 1 categories. Out of these, the class 5 category recorded the highest growth in the market in the past few years. These forklifts are driven by internal combustion engines (ICEs) and are extensively used in various developing countries such as Mexico, India, Brazil, and China. They are heavily used in heavy lifting applications.

This is because these forklifts have pneumatic tires, which are ideal for work environments where the tire puncture risk is very high. When engine type is taken into consideration, the market is classified into electric and ICE. Between these, the electric category will exhibit faster growth in the market in the future years. This is credited to the growing demand for eco-friendly forklifts in factories. Additionally, the reducing prices of lithium-ion (Li-ion) batteries are propelling the sales of electric forklifts.

Geographically, the forklift market will demonstrate the highest growth rate in the Latin America, Middle East, and Africa (LAMEA) region in the upcoming years. This would be a result of the increasing industrialization and the surging establishment of warehouses in the developing nations of the region. Additionally, the rapidly expanding e-commerce sector and the changing customer buying habits are fueling the demand for faster warehouse operations, which is, in turn, pushing up the demand for forklifts in the region.

Detailed Analysis of the Forklift Market Trends