The major drivers in the global non-woven adhesives market are the skyrocketing requirement for these products in the textile sector, growing awareness about better quality products, and surging demand for these adhesives in adult incontinence, baby care, and feminine hygiene applications. The market will grow at a significant pace in the coming years. However, the outbreak of COVID-19 had disrupted several markets and this market was not an exception. Lockdowns were imposed in several economies amid the pandemic rupturing the logistical network of the market owing to the complete or partial manufacturing unit closures.

The swift adoption of technologically advanced devices will provide lucrative opportunities for players to adapt to the existing market dynamics and paradigm shifts in the tastes and preferences of consumers. In addition, the essentialities of any market are purchasing power and demographics.

Moreover, a rising disposable income will exert a push on the purchasing power of the consumer, thus driving the global hygiene products market. Furthermore, technological advances in the hygiene market have resulted in better comfort, thinner cores, enhanced bodily fluid absorption capabilities, and reduced waste generation.

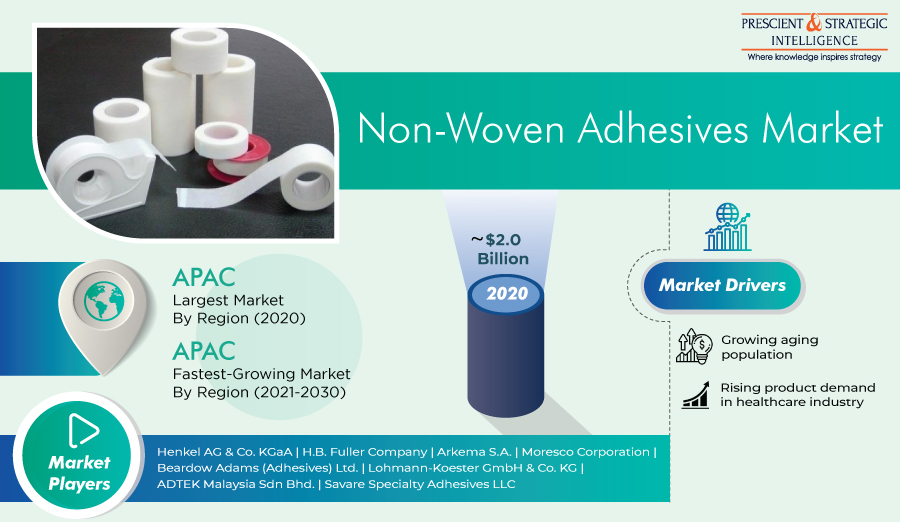

The rising geriatric population on account of a higher life expectancy will boost the non-woven adhesives market growth. This can be credited to a snowballing demand for non-woven hygienic adhesives for adult diapers, especially in the developed nations, including Western European countries, Japan, and the U.S. In fact, in these countries, there is a surging requirement for adult diapers in comparison to baby diapers. Furthermore, the global healthcare business will also drive the market because of the benefits of non-adhesives including sterile dressing, holistic wound protection, and high absorption.

The global non-woven adhesives market is driven by the highly competitive nature of market players in the process of opening lucrative opportunities and gaining a competitive edge. These market players are indulging in technological innovations to retain their position in the market. These include Palmetto Adhesives Company Inc., Cattie Adhesive Solutions LLC, Savare Specialty Adhesives LLC, ADTEK Malaysia Sdn Bhd., Lohmann-Koester GmbH & Co. KG, Beardow Adams (Adhesives) Ltd., Moresco Corporation, Arkema S.A., and H.B. Fuller Company.