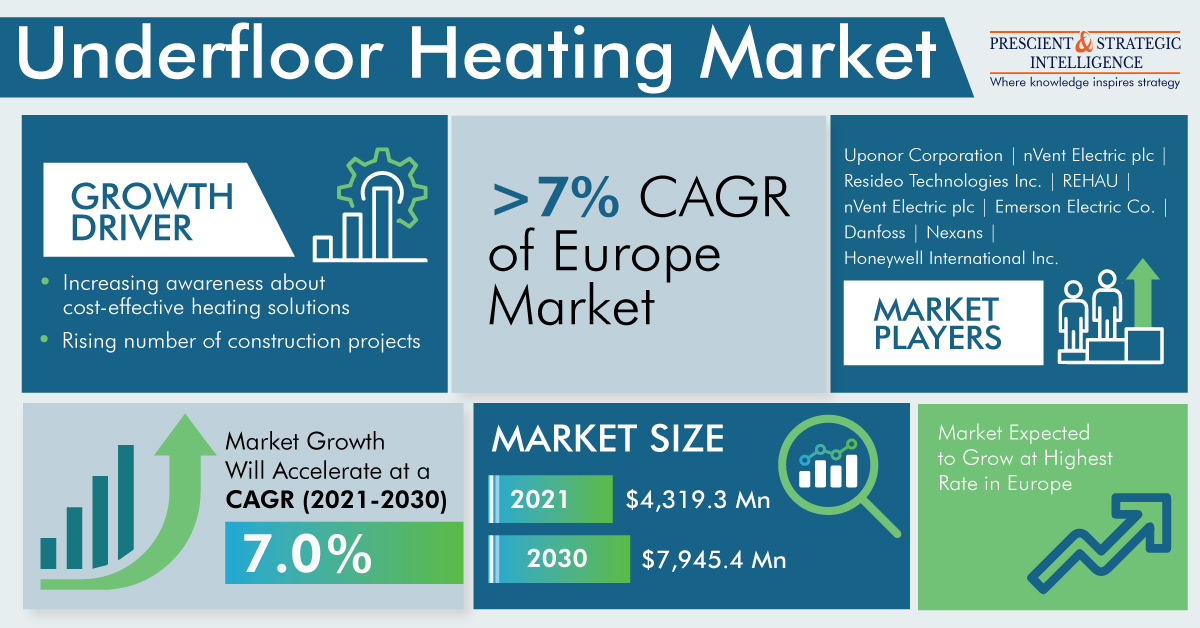

The underfloor heating market will touch USD 7,945.4 million, advancing at a 7.0% compound annual growth rate, by 2030.

The growth of this industry is mainly because of the rising consciousness regarding cost-effective heating solutions as well as the growing count of construction projects.

Additionally, because of the increasing living standard of people in European and North American nations, the industry has witnessed significant advancement. Heating controls allow central heating systems to function automatically, with the user’s only effort being to temporarily override or update the program.

Moreover, a hydronic underfloor heating system comprises thermal actuators, network pipes, zone valves, manifolds, and wiring centers, which together provide more heat compared to an electric system at a lower operating price. Therefore, hydronic, under the hardware category led the industry, and it will further advance at a 7.2% compound annual growth rate in the year to come.

Furthermore, heating pipes, under the hydronic subcategory, was the largest contributor to the industry. This can be mainly because they are the key element in such a system.

The residential category, on the basis of end user, was the largest contributor to the underfloor heating market, in the past few years. This can be mainly because of the increasing count of smart home initiatives, coupled with the extensive refurbishment activities. Additionally, businesses are producing technologies for effective heating in new and renovated apartments.

The commercial category, on the other hand, is likely to advance at the second-fastest rate, in the years to come. Due to the surging need for effective floor heating in retail enterprises and workplaces, the category will continue to advance.

Europe led the industry in recent years, and it will further advance at the highest rate, of more than 7.0%, in the years to come. This is because of the active involvement of government organizations in protecting the environment, through the utilization of energy-effective systems.

Furthermore, the German New Building Energy Act concentrates on the necessities for the energy performance of buildings, the usage and issue of energy performance certificates, and the employment of renewable energy in buildings.

North America is likely to witness the second-fastest growth in the years to come. This is because of the continuous funding of new technologies by the major companies operating in this region.

With the increase in the number of construction projects, the underfloor heating industry will continuously grow in the coming years.