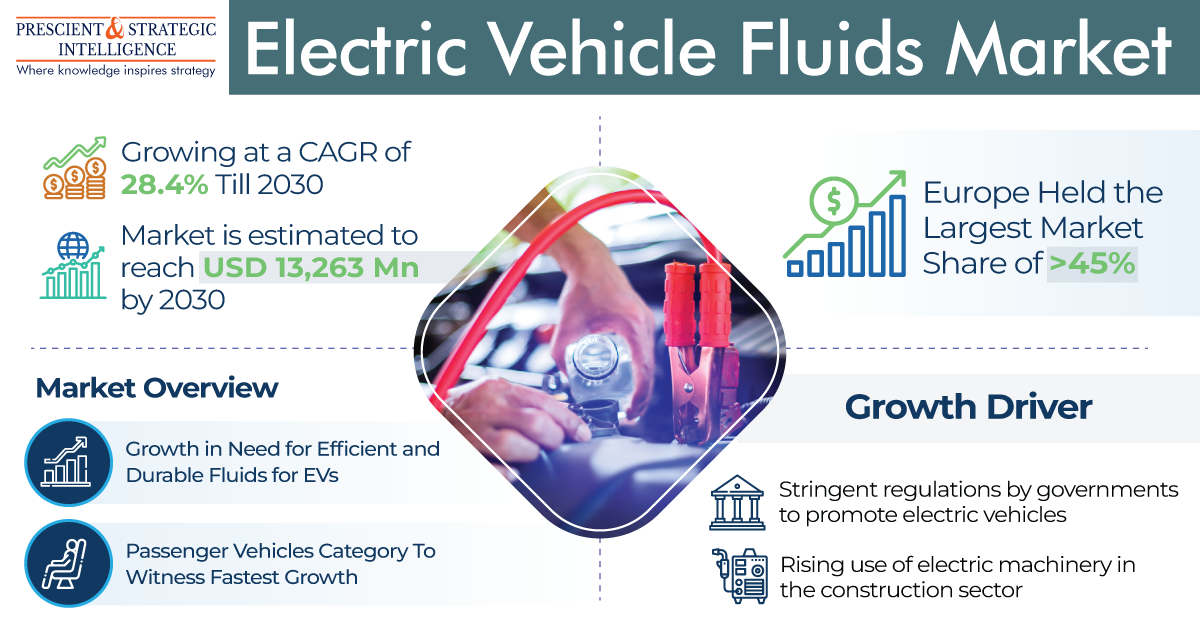

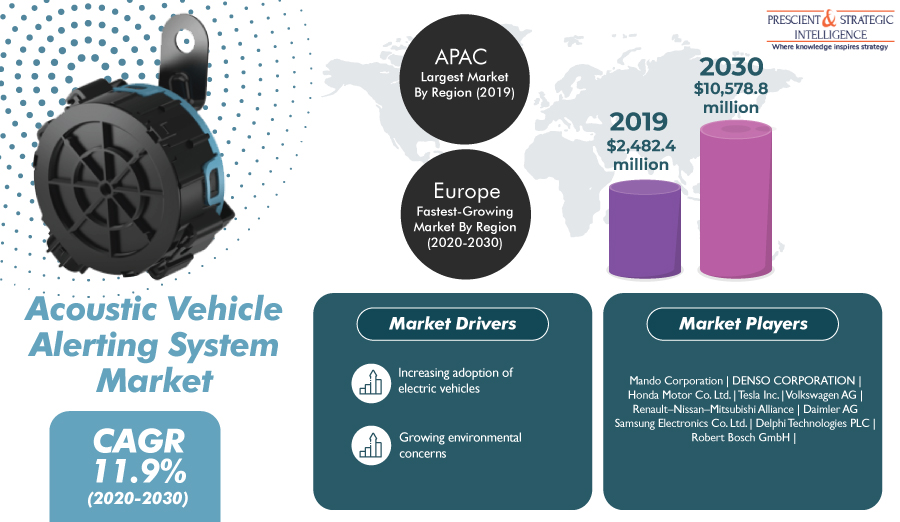

In a world where sustainability and invention go hand in hand, the vehicle sector is experiencing a ground-breaking shift towards electric powertrains. The need for electric vehicles (EVs) fortified with electric powertrains has observed an unprecedented rise, propelled by both ecological consciousness and the tempting assistances these futuristic systems bring to the table.

The electric powertrain market is witnessing growth and is projected to reach USD 226.3 billion by 2030.

Unprecedented Demand:

The global requirement for electric powertrains has risen steeply in the past few years, copying the rising concentration in electric-powered vehicles. Customers, businesses, and governments are progressively spotting the requirement to transition from outdated internal combustion engines to electric-powered choices. This requirement for the rise might be credited to many reasons, with ecological issues topping the list. An electric powertrain system is a system of components that generates and delivers power to the road surface for electric vehicles.

Environmental Benefits:

The environmental advantages of electrical powertrains are possibly the most compelling thing driving their call. Unlike traditional combustion engines that rely upon fossil fuels, electric-powered powertrains operate on power, notably lowering greenhouse gas emissions. This shift aligns with worldwide efforts to fight air pollution and mitigate the impact of climate change.

Economic Benefits:

The advantages of electric powertrains enlarge past the environmental realm, supplying compelling monetary benefits. Electric automobiles typically have decreased operating prices as compared to their conventional outdated counterparts. With fewer shifting parts and simplified preservation necessities, proprietors of electrical vehicles enjoy decreased expenses associated with upkeep and servicing.

Additionally, governments worldwide are making an investment in the development of charging infrastructure, further incentivizing the adoption of electric motors. This infrastructure not only enables convenient charging but also stimulates job creation and economic boom. As electric powertrains become extra usual, the related economic blessings are poised to have a widespread effect on various industries and nearby economies.

Technological Advancements:

Electric powertrains are at the forefront of technological innovation in the car sector. These systems boast superior functions, including regenerative braking, advanced power efficiency, and seamless integration with clever technologies. The constant evolution of electric powertrain technology contributes to better performance, longer battery life, and extended use variety, addressing early concerns approximately the practicality of electrical vehicles.