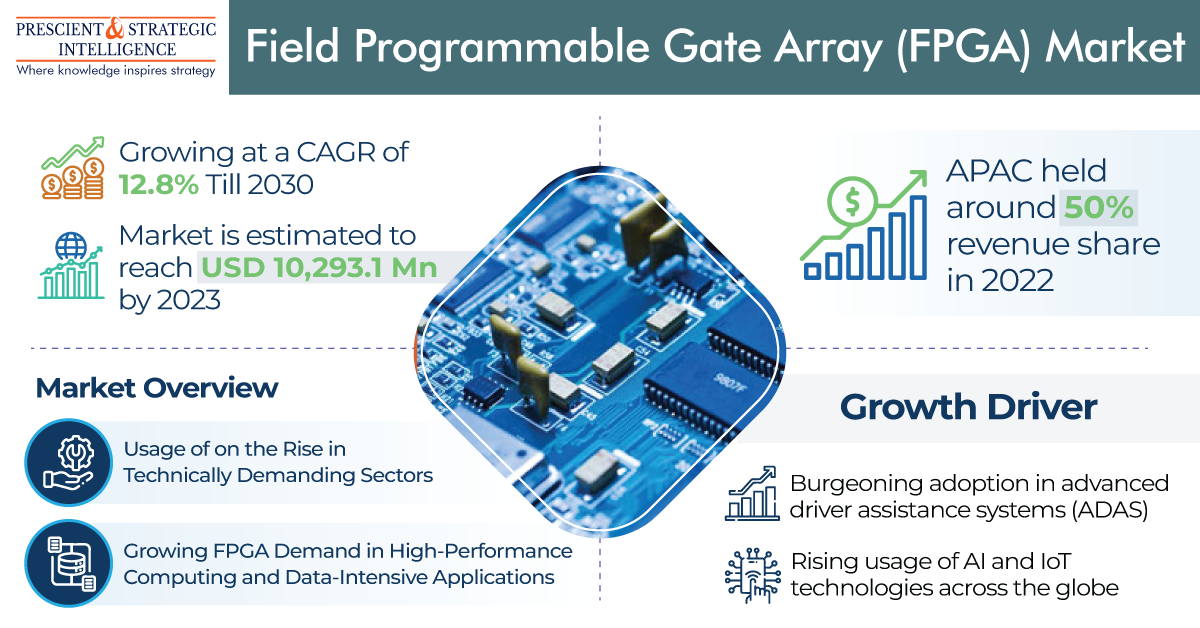

The FPGA market was USD 9,121.1 million in 2022, and it will propel at a 12.8% CAGR, to touch USD 23,991.2 million, by 2030.

The growth of the industry is attributed to the growing acceptance of advanced driver assistance systems, surging data centers and high-performance computing deployment, and mounting utilization of IoT and AI technologies all over the world. Furthermore, with the increasing utilization of this technology, the requirement for field-programmable gate array (FPGA) hardware verification is increasing in avionics applications.

In 2022, the SRAM category, based on technology, held the largest FPGA market share, of 60%, and it will remain the largest in the years to come. This is attributed to the advantages offered by SRAM, including high performance, flexibility, in-system reconfiguration, and easier usage. Applications based on static random-access memory (SRAM) technology can be found in various industries, such as aerospace & defense, automotive, communications & networking, and consumer electronics.

Additionally, the SRAM technology is extensively used in aerospace & defense applications for communication systems, radar processing, signal intelligence, and secure data transmission. Moreover, in military settings, the ability of field reconfigurable these components possessed is particularly beneficial for avionics, electronic warfare, high-performance computing, and cybersecurity, which will further drive the advancement of this category throughout this decade.

In 2022, the 20–90 nm category, based on node size, held the largest share in the industry, and it is expected to remain the largest throughout this decade. This is attributed to the advantages offered by 20–90-nm FPGAs, such as reconfiguration freedom, low power consumption, and great performance.

APAC held the largest share in the industry, of 50%, in 2022, and it is likely to remain the largest during this decade. This is primarily attributed to the rising investment in the communications & networking sector in the continent. This will also boost the requirement for FPGAs in India in the years to come, as the country is focusing on telecom infrastructure advancement, such as the 5G connectivity deployment to boost its economy.

The North American FPGA industry is advancing at a steady pace, owing to government initiatives to promote electronics & semiconductor businesses to use more of the FPGA technology to attain cost-efficiency. Additionally, the defense and telecommunications industries, as well as the ICT sector, are progressing in North America, therefore, boosting the utilization of FPGAs in the region.