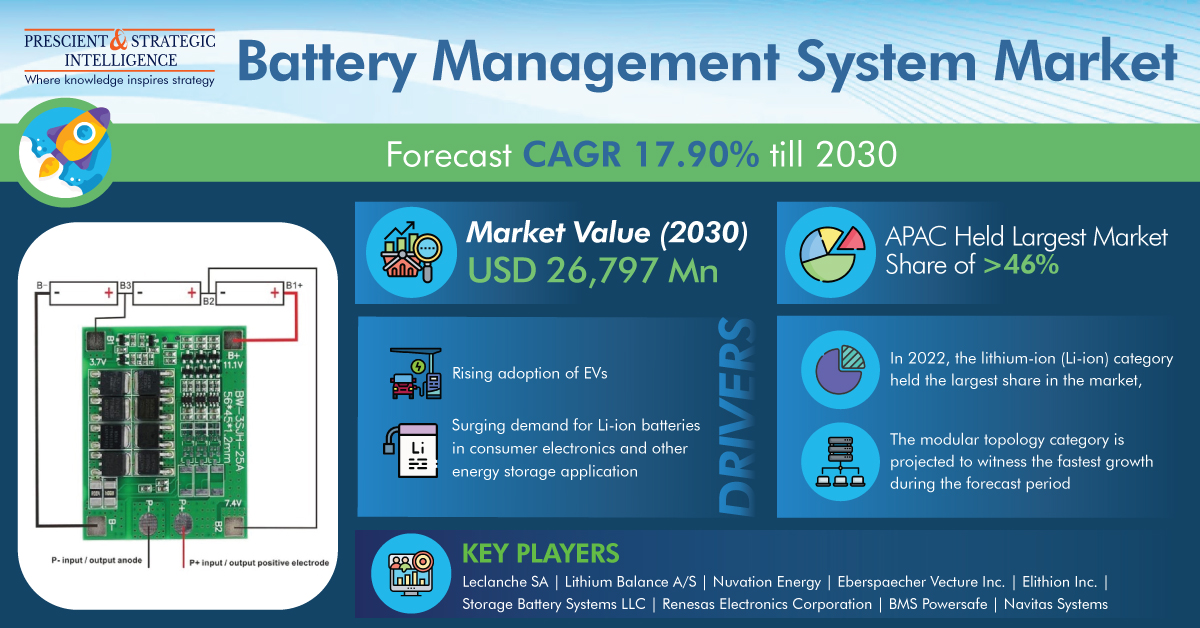

The value of the battery management system market stood at USD 7,177.5 million in 2022, and this number is projected to reach USD 26,797 million by 2030, advancing at a CAGR of 17.90% during 2022–2030.

This growth can mainly be credited to the growing demand for e-vehicles and the mounting use of electric batteries in consumer electronics.

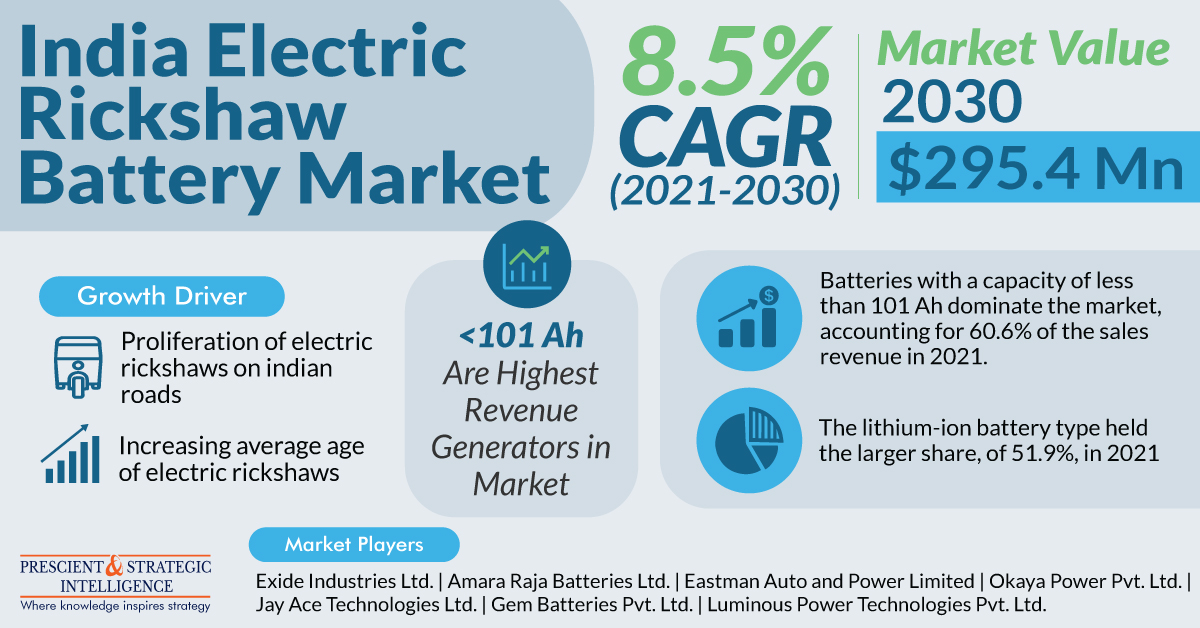

The lithium-ion category had the largest market share, in 2022, as Li-ion batteries offer numerous benefits over other battery types, including better energy density, improved resilience, a longer lifespan, and lower maintenance needs.

Additionally, Li-ion batteries are green, as they comprise comparatively lower levels of poisonous heavy metals than other battery types, including lead–acid, and nickel–cadmium.

The modular topology category is all set to experience the fastest growth by the end of the decade. For most of the manufacturers, modular topology is ideal, as it offers considerable computational power and is safe to use, as it doesn’t require wide wire harnesses.

Modular topology is also appropriate for several functionalities, including energy storage systems, in industrial UPS, medical mobility vehicles, drones, and parts of electric vehicles.

In order to evade vehicle failure, such cells should be kept and regulated, creating the system a serious component in the e-vehicle design. The system regulates the battery’s performance, utilization, and safety. It also surges the battery lifespan and range of the vehicle.

Additionally, China dominates the APAC industry, as it is a central hub of automotive manufacturing. The national market is boosted by a surge in the production of batteries and automobiles utilized in vehicles. Also, China is a global dominator in the manufacturing of electrical equipment. This is projected to boost product demand.

Hence, the growing demand for e-vehicles and the mounting use of electric batteries in consumer electronics are the major factors contributing to the growth of the battery management system market.