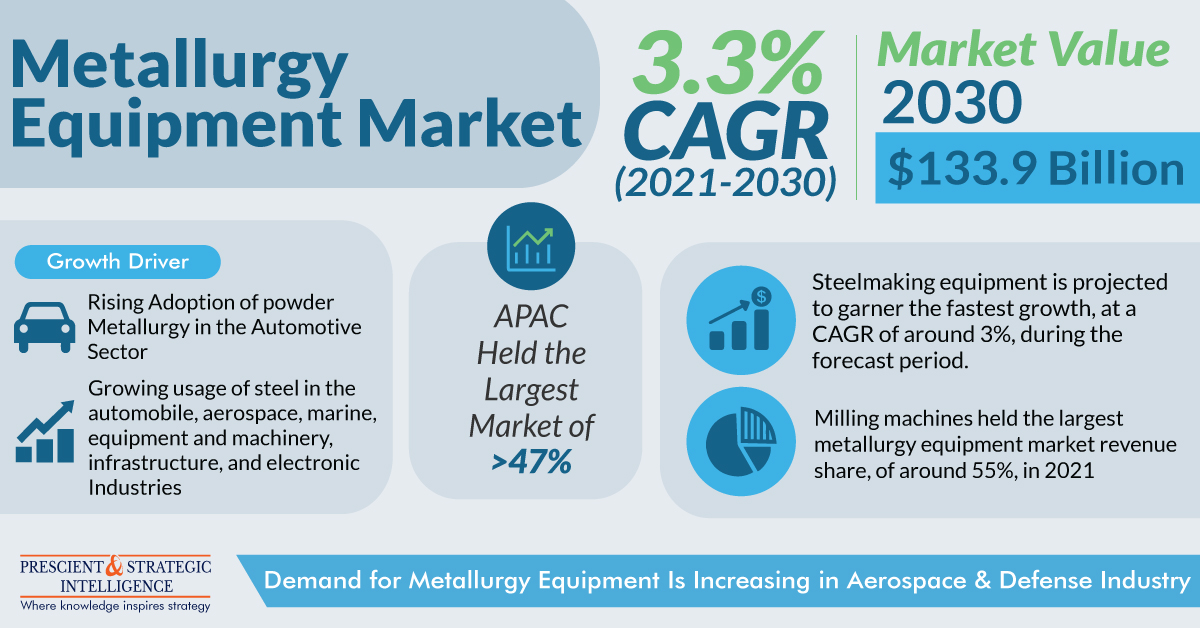

The metallurgy equipment market will touch USD 133.9 billion, propelling at a 3.3% compound annual growth rate, by 2030.

Digitalization is a key aspect of modern metallurgy. All practices are fully automated, whereby the utilization of robots is also expected in unsafe working areas, which essentially surges safety at the workplace.

The steelmaking equipment category, based on type, is likely to advance at the fastest rate, of approximately 3%, in the years to come. This can be attributed to the increasing usage of steel across sectors such as aerospace, automobile, marine, infrastructure, electronics, and equipment & machinery.

Moreover, steel is crush-and corrosion-resistant and, thus, enhances the durability and safety of automobiles. The increasing requirement for hybrid and electric vehicles is likely to further drive the demand for steel, boosting steelmaking equipment sales.

The milling machines category, based on equipment, accounted for the largest metallurgy equipment market share in recent years, and it will also propel at a significant rate during this decade. This can be because milling machines are highly versatile and can execute various functions, such as facing, turning, fillet making, chamfering, gear cutting, slot cutting, and drilling.

Moreover, with the increasing labor charges in developed countries, businesses are utilizing software programs to control the spindle speeds, tool changes, and axis in milling machines. In addition, businesses are accepting CNC technology to enhance the efficiency of milling machines and the quality of work.

In the past few years, the aerospace & defense category, based on application, was the largest contributor to the industry. This can be because of the increasing requirement for powdered aluminum, steel, and titanium in different aerospace & defense applications because of their capability to reduce the weight of aircraft components and enhance their effectiveness.

Moreover, the rising passenger traffic & defense budget in the APAC and European regions also help the progression of this industry. For example, APAC had shown a rise of approximately 200% in airline traffic in March 2022 as compared to March 2021.