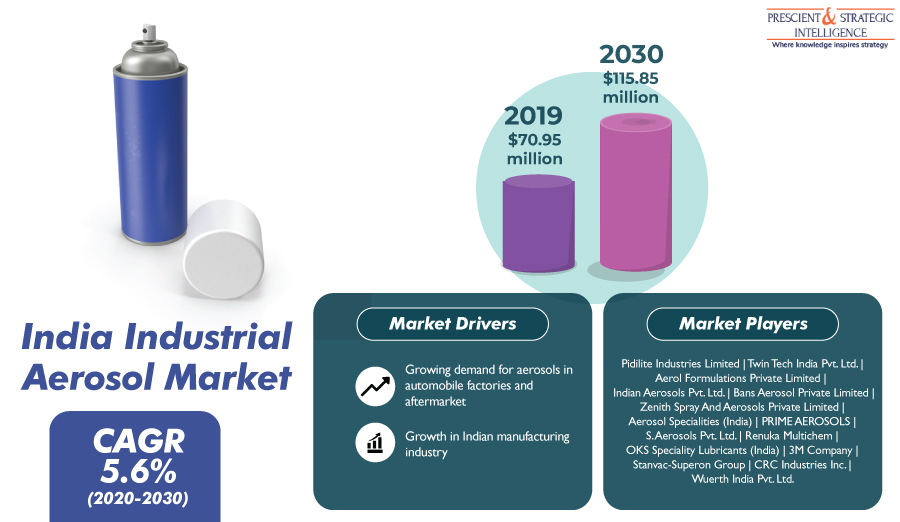

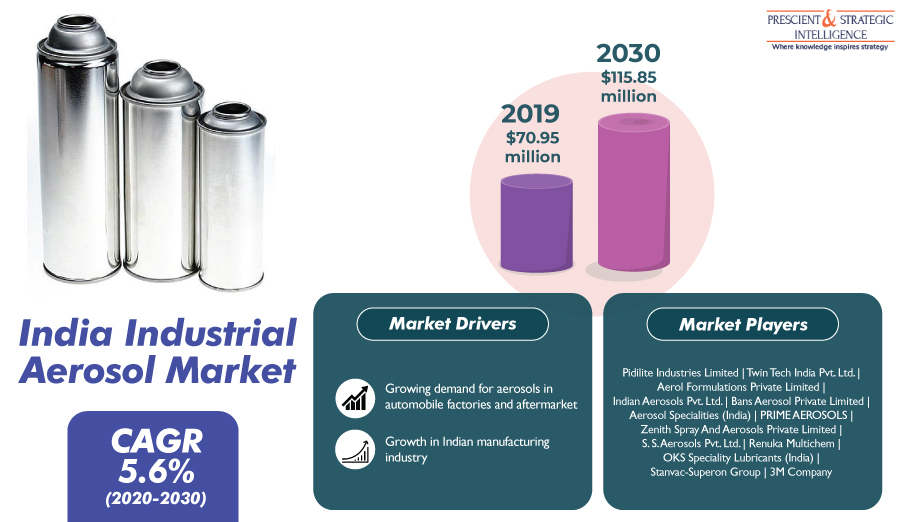

The major drivers in the India industrial aerosol market are the skyrocketing investments in the research and development in the Indian manufacturing sector, extensive government support, and surging application of aerosolized products in automotive plants as well as garages and repair shops. Therefore, the sale of such products across the country will collectively fetch companies $115.85 million by 2030.

The COVID-19 virus spread like wildfire, infecting millions worldwide. Because aerosols are heavily utilized in the form of paints, greases, lubricants, maintenance sprays, and cleaning products in the manufacturing sector, the demand for them was seriously impacted.

Spray paints are the most-significant application in the India industrial aerosol market share. This is largely due to the Indian population’s increased purchasing power, which is driving the demand for spray paints with an aerosol base in auto manufacturing facilities and in repair shops and garages. The spray paints category will potentially grow in the coming years because of the economic viability and versatility of spray paints. There is a rising utilization to re-spray or restore aviation and automotive components. Additionally, there is a surging application of spray paints to fill the scratches in industrial machinery.

The growth of the players in the India industrial aerosol market is essentially due to the uptick in the sales of quadricycles, two-wheelers, three-wheelers, commercial vehicles, and passenger cars. Moreover, there is a significant increase being observed in the count of vehicles produced, the Society of Indian Automobile Manufacturers says. Similarly, as per the IBEF research in 2020, car demand is predicted to increase owing to an increase in the youthful population and in the disposable income of the middle class, which would propel the demand for such products in the next years.

The manufacturing industry of the country is expanding robustly due to increased demand for consumer electronics and electronic appliances, as well as machinery and electrical equipment as per the IBEF. This will spur the India industrial aerosol market growth. Furthermore, according to government sources, substantial development has been noted in the beauty and cosmetics industry of the nation over the last several years as a result of growing per capita income, which is leading to increased personal expenditure.