The virtual power plant market will power at a rate of 16.9% in the years to come, reaching USD 12,273.3 million by 2030, as stated by P&S Intelligence.

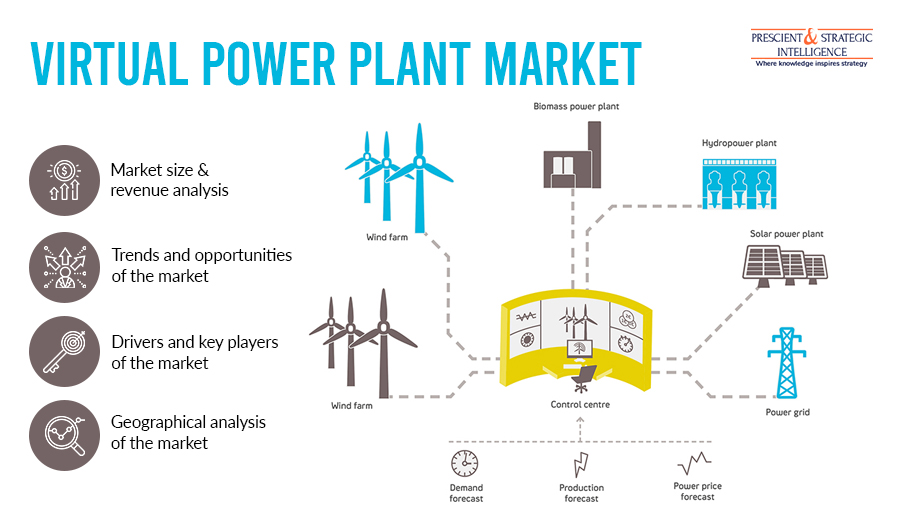

This is because of the increasing acceptance of cutting-edge technologies such as IoT and cloud platforms in the power sector, the increasing consciousness toward the advantages of renewable power, the availability ease of power through VPP platforms, and the growing emphasis on cost-efficiency in generation of power.

This is because of the higher acceptance of this technology in industrialized nations, as a result of direct advantages offered to end customers as incentives for varying their consumption of power; an increase in the necessity for energy consumption; and it lets users to participate in the energy load drop throughout peak demand periods with the use of VPP software and solution.

This is because of the to the high electricity sales to industrial customers; the quick industrialization in China, Brazil, India, and Indonesia; and favorable policies proposed by numerous governments concerning energy consumption.

Power evacuation infra, characterized by power transmission and distribution networks, is either outdated or insufficient. In the majority of cutting-edge countries, power transmission networks are outdated and not able to accommodate the intermittent flow of electricity supplied by renewable power projects.

Furthermore, everyday network failure and high transmission and delivery losses result in loss of revenue to power utilities. In developing nations, the transmission of power network is extremely insufficient to cater to the increasing power demand.

Furthermore, the increasing use of virtual energy units for optimal energy distribution boosts the growth of the energy in the region.

Due to the increasing awareness of advantages of renewable power, the demand for virtual power plant will continue to grow in the years to come.