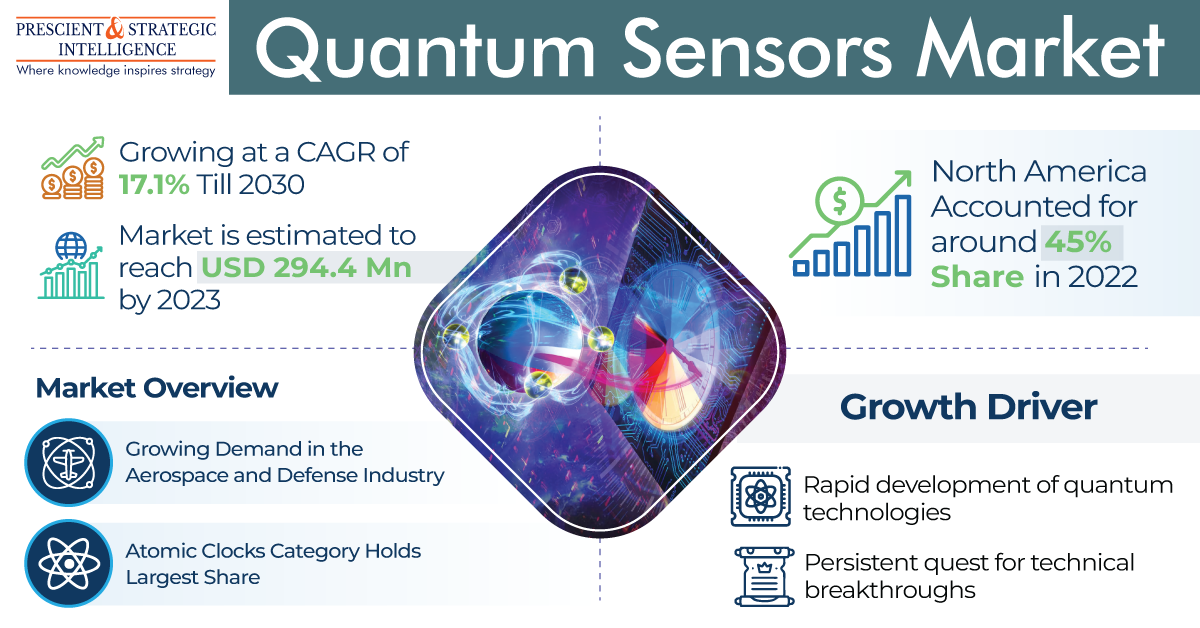

The total value of the global quantum sensors market was USD 251.4 million in 2022, and it will rise at a growth rate of above 17.1% between 2023 and 2030, reaching USD 889.4 million by 2030. This can be credited to the wide utilization of such sensors to ‘re-build’ an extensive variety of businesses and applications. Quarks, protons, gluons, neutrons, and electrons are utilized in the quantum mechanics concept. This sensor has an enormous demand in the aerospace, defense, and healthcare industries credited to its benefits over orthodox technologies.

The technical improvements in quantum sensors are the major reason propelling the development of the industry. This can be credited to the increasing acceptance of this technology in numerous sectors, like oil & gas, aerospace, healthcare, and defense.

Moreover, as more R&D is done in the field of science and technology, a more-vital role will be played by such detectors. They have the capability to offer improved accuracy and sensitivity, which can be attained by making utilization of quantum phenomena, like superposition and entanglement. This makes it likely to gauge physical properties, like electric fields, magnetic fields, temperature, and gravity, with better precision and speed.

In 2022, on the basis of product type, the atomic clocks category held the largest share, of 40%, in the quantum sensors industry, and the category is also projected to remain dominant in the future as well. This can be credited to the excellent accurateness of such instruments, improvements in technology, growing demand for exact timing, and ongoing research and development. Such reasons combine to guarantee that atomic clocks serve an extensive variety of sectors and applications that hinge on exact timekeeping and synchronization.

North America is the largest quantum sensors industry, contributing approximately 45% of the global revenue, and it is further projected to remain dominant in the future as well. This is credited to its solid technical infrastructure, high expenditure in R&D, the existence of key end-use sectors, and helpful government guidelines in the continent.

Hence, the wide utilization of such sensors to ‘re-build’ an extensive variety of businesses and applications are the major factor propelling the quantum sensors market.