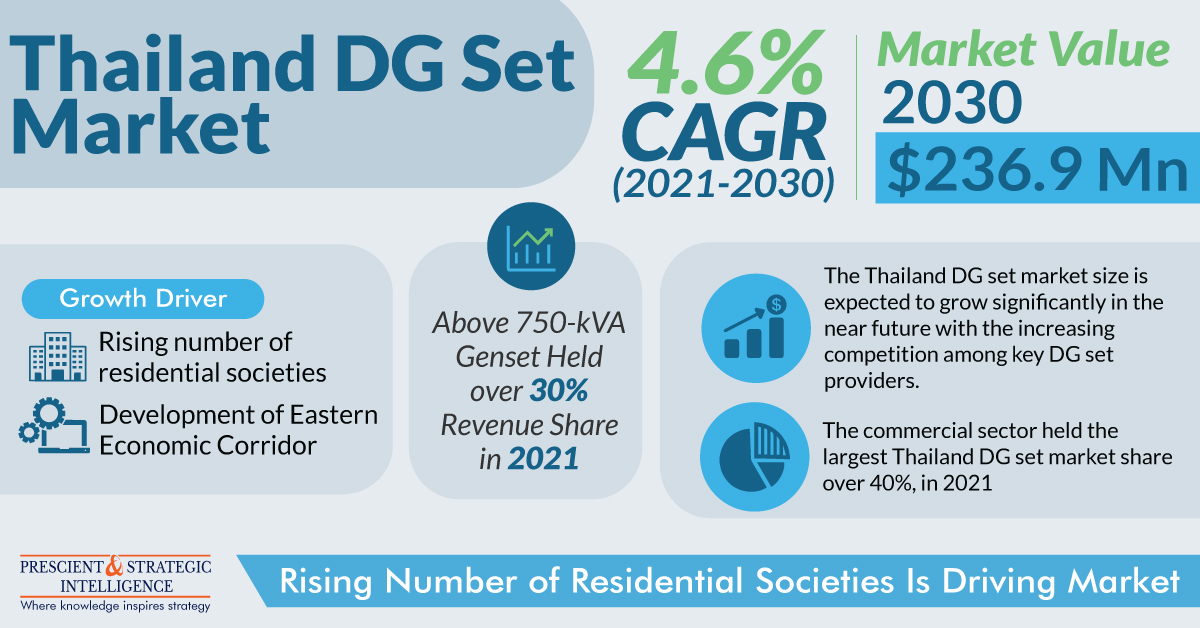

In Thailand there is a significant development in various infrastructures such as resorts, hotels, hospitals, offices, and others, which is generating a large necessity for power backup solutions, for instance, DG sets.

Moreover, DG sets are also gaining popularity in Thailand due to the increasing need for power generation systems on islands with unreliable or no grid connectivity. For example, as per an article in Taipei Times, Ko Phaluai Island in Thailand has zero central electricity source, as a result, individuals utilize small diesel-fueled generators to provide power.

DG sets can be turned off or on in just a few seconds, therefore these machines have fast response and by utilizing a liquid fuel, they can function without interruption for a long duration.

Increasing Residential Societies in Thailand Boost DG Sets Sell

Funding by governments and real estate organizations is increasing in the residential sector of Thailand. The advancement of the residential sector is well accompanied by that of the sector of corporate because it is boosting the requirement for semi-urban and urban housing, which significantly increase the need for DG sets in residential area.

Moreover, the Thailand government has enlarged its funding to develop and enhance its infrastructure in the last few years, via public–private partnerships and public investments. During the last decade, the Thailand government invested around USD 116 billion for the infrastructure progression. This will generate a positive impact on the sales of DG sets in the nation.

Types of DG Sets Used in Thailand

DG sets can be categorized based on their power rating, types of DG sets include 5–75 kVA, 76–375 kVA, 376–750 kVA, and above 750 kVA. Among these, the above-750-kVA DG sets are the most extensively used type in Thailand. This is mainly due to the high-power necessity in the industrial settings in the nation.

The nation is a top producer of high-tech goods, particularly those related to electronics and automobiles. In addition, the emphasis of the nation is on the manufacturing of additional value-added products, for its economic advancement, which urges startups to increase their facilities of production, as a result, increasing the need for DG sets.

Coming to an End

The DG set sector in Thailand is likely to advance significantly in the years to come with the surging competition between major providers of DG set. Furthermore, new businesses are more involved in collaborating with other providers, therefore further increasing the levels of competition.