In June 2023, the Uttarakhand High Court has asked the Nagar Palika Parishad to convert all pedal/cycle rickshaw permits to e-rickshaw permits. This is in keeping with the rising demand for these eco-friendly modes of short-distance transport across the country. According to the Federation of Automobile Dealers Associations (FADA), electric rickshaw sales in the country in February 2023 were 89% compared to February 2022.

Most of these sales are powered by the government initiatives to urge people to shun their petrol/diesel vehicles, at least for short distances and last-mile commuting, and opt for public transport instead. For instance, in 2020, the Tamil Nadu government had unveiled over 10 types of battery- and solar-powered rickshaws. The state government had also announced its EV policy in 2019 with the aim to garner USD 7 billion (INR 500 crore) worth of investment in EV manufacturing.

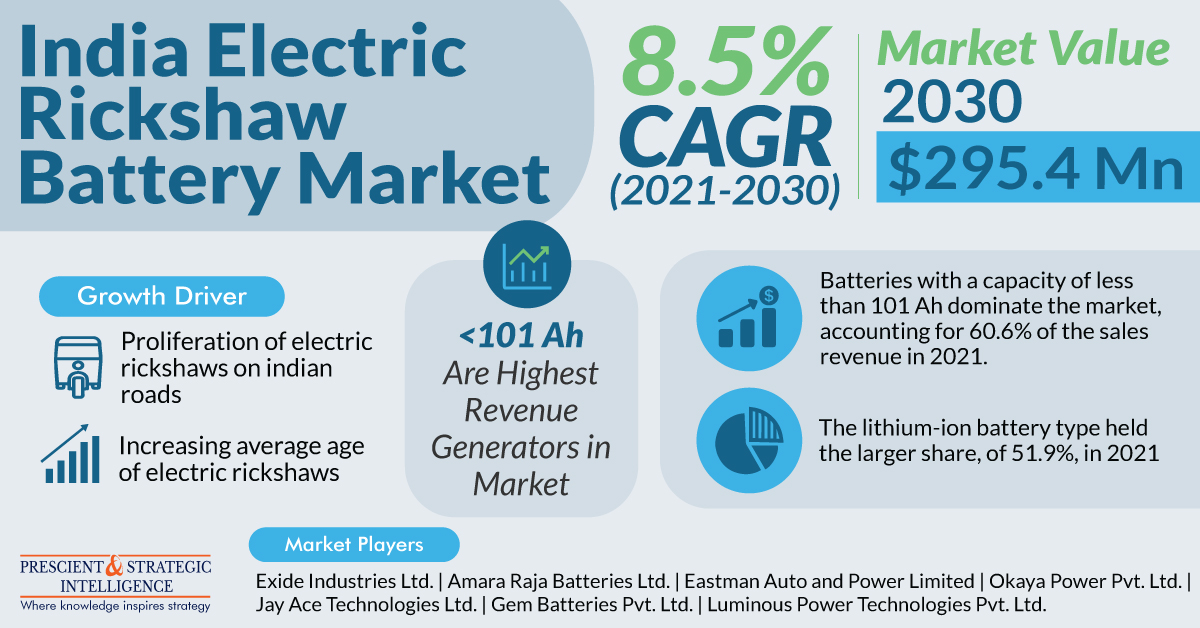

Moreover, a report had pointed out that only eight Indian states had fewer than 1,000 of these registered three-wheelers and that Uttar Pradesh, Delhi, and Bihar topped in e-rickshaw registrations, with 403,411; 117,885; and 108,669 vehicles registered. Such numbers hint at a major opportunity for companies in the Indian electric rickshaw battery market, which has been forecast by P&S Intelligence to reach USD 295.4 million by 2030.

Just like any EV, the battery and motor are the costliest components of an e-rickshaw. This is why the battery needs to be highly efficient, allowing for long driving ranges on a full charge, and have a long overall life for it to be cost-effective. Up till half a decade ago, sealed lead–acid (SLA) batteries were preferred because they were the only ones available, widely known, and cost-effective.

However, with concerns over the short driving range, disposal issues, short life, and fewer charge cycles they entail, lithium-ion batteries are becoming increasingly popular. Still, despite their advantages of a higher charge capacity, lower self-discharge rate, more charge cycles, and longer life, their sales are somewhat marred by their higher price. This is because lithium and cobalt, two of the key materials utilized in these power storage systems, are costly.

Moreover, since India sources all of its lithium from other countries, the import duty makes it even more expensive. Between the April of 2022 and January of this year, we imported lithium worth INR 18,763 crore. However, in February 2023, the Geological Survey of India found 5.9 million metric tonnes of Li reserves in the Reasi district of Jammu & Kashmir. With the government planning to swiftly auction the blocks to private players for extraction, Li-ion battery production in India could get a boost and the prices of these components could come down.

Other states with possible reserves of this key metal are Rajasthan, Jharkhand, Chhattisgarh, Arunachal Pradesh, Meghalaya, Nagaland, Gujarat, and Ladakh (UT). Experts believe that with India beginning to locally source lithium, the price of cells for Li-ion batteries could come down by up to 30%, which could make e-rickshaws cheaper by 15%, if not more.