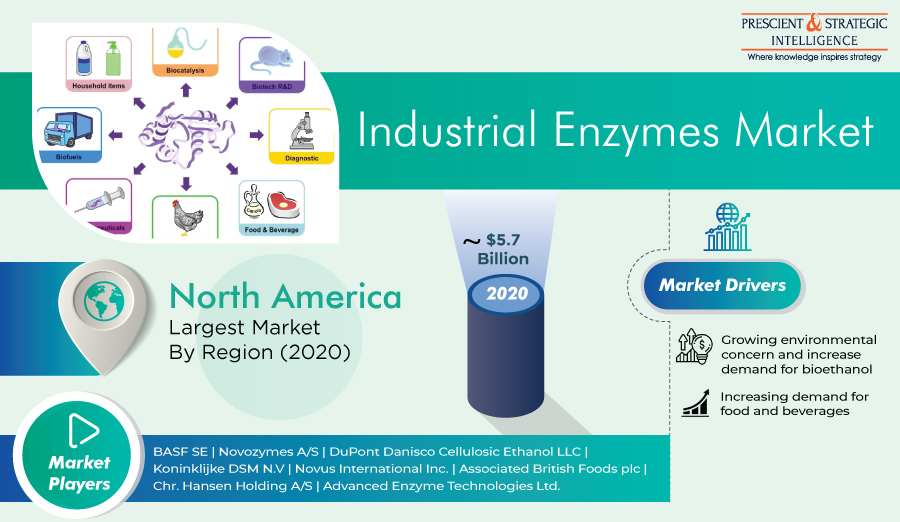

As per a report by a market research institution, P&S Intelligence, the industrial enzymes market is experiencing significant growth, and it will continue like this in the years to come as well.

The growth of the industry is mainly due to the widespread R&D activities, increasing environmental concerns, quick industrialization, the mounting requirement for bioethanol, advancement in the nutraceutical sector, and growing requirement for protease and carbohydrase in the food & beverage sector.

In the past few years, the carbohydrases category, based on type, accounted for the largest industrial enzymes market share. This is credited to the several applications of this enzyme in numerous industries, such as animal feed, food & beverage, and pharmaceuticals.

In recent years, the microorganism category, based on source, accounted for the dominating industry share, and it will advance significantly in the years to come. This is credited to the fact that various enzymes are derived from fungi, yeast, and bacteria.

Based on application, the food & beverage category accounted for a significant share in the past few years. This is because industrial enzymes are important in nutritious food & beverage product production.

In the past few years, the North American industrial enzymes industry accounted for the largest industry share, both based on value and volume, and it will remain the largest in the years to come.

Moreover, the growth in the regional industry is ascribed to the increasing number of clinical trials to develop effective therapeutics, surging technological advancements, rules for biofuel production, the existence of global players, the growing food and beverage processing sector, and rising high-performance items developments for instance biopolymers, processed food, and biofuels.

A major trend observed in the industry is the multifunctional utilization of industrial enzymes.

The depletion of non-renewable resources has resulted in the increasing importance and requirement of bioethanol production, which has a small impact on the environment. Ethanol derived from biomass can be used as a replacement, octane enhancer, or extender for traditional motor fuels, for instance, diesel, kerosene, and gasoline in countries which has excess agricultural capacity.