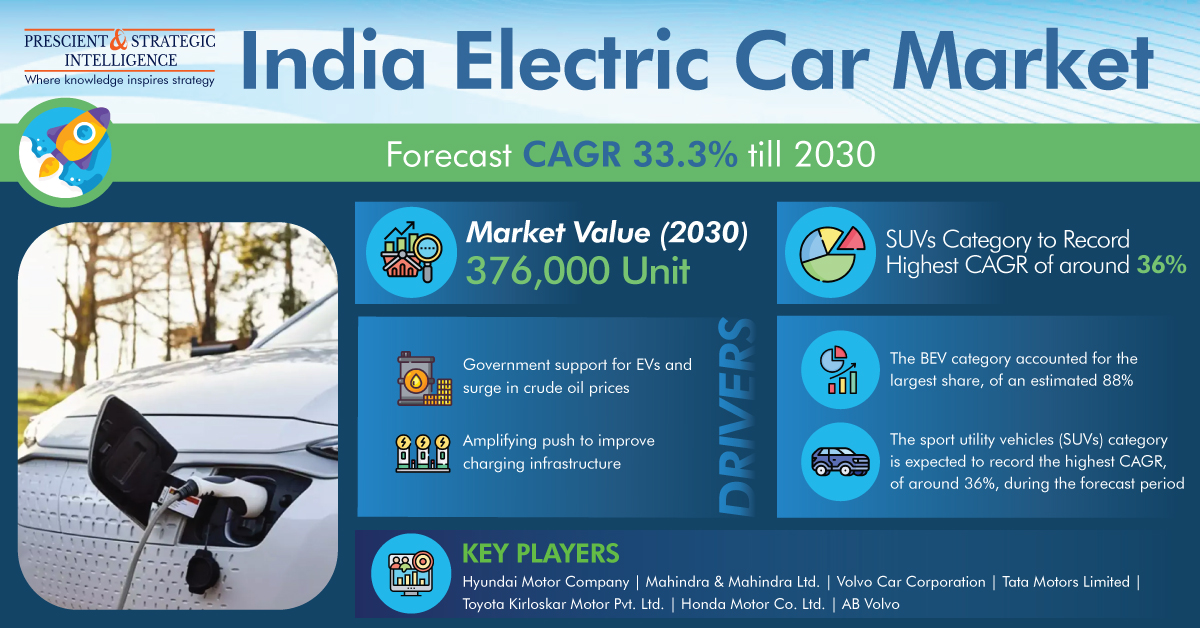

Electric cars are also known as battery-electric vehicles. These cars are equipped with electric motors in place of the internal combustion engine. It requires a large traction battery pack to power up the electric motor. It needs to be plugged into the wall outlet or charging equipment. It is also known as the electric vehicle supply equipment.

Moreover, it runs on electricity. The vehicle captures no tailpipe exhaust, and it does not contain any typical liquid fuel components, including a fuel line, fuel pump, or fuel tank.

Major Components of All Electric Car

Battery: An electric drive vehicle is equipped with an auxiliary battery that offers electricity to power vehicle accessories.

Charge Port: The charge port facilitates the vehicle to connect to the external power supply for charging the traction battery pack.

Read More India Electric Car Market Growth Insights Report

DC/DC Converter: It converts the higher-voltage DC power to the lower-voltage DC power from the traction battery to facilitate powering the vehicle accessories and recharging the auxiliary battery.

Electric Traction Motor: It utilizes the power from the traction battery pack to drive the wheels of the vehicle. Several vehicles may utilize motor generators to perform both drive and regeneration functions.

Onboard Charger: It consumes the incoming AC electricity supplied through the charge port, and converts the DC power to charge the traction battery. It also interacts with the charging equipment and monitors the characteristics of the battery, such as current, voltage, temperature, and state of charge during the charging of the pack.

Power Electronics Controller: It manages the electrical energy flow delivered through the traction battery and controls the electric traction motor speed, and torque produced by it.

Thermal System (Cooling): It maintains the proper operating temperature range of the engine, power electronics, electric motor, and other components.

To receive free sample pages of this report@ https://www.psmarketresearch.com/market-analysis/india-electric-car-market/report-sample